44+ do mortgage lenders use gross or net income

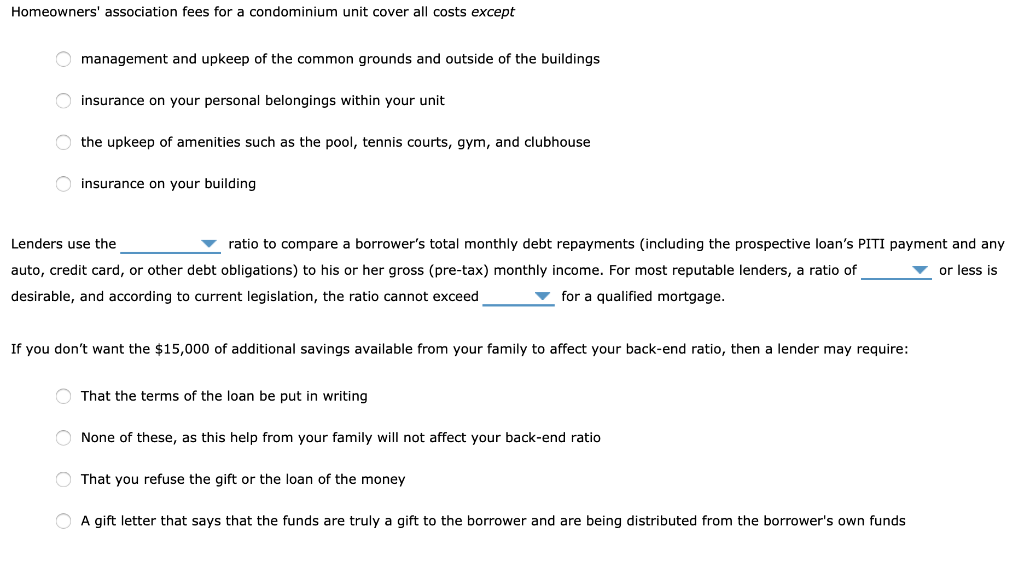

28 of your income will go to your mortgage payment and 36 to all your other household debt. Ad View Rates and See How to Get Pre-Qualified for a Home Loan in 3 Minutes.

Free 3 Self Employment Sworn Statement Samples In Pdf Doc

Web Lenders use gross and net business income if you dont qualify for a mortgage when they use a traditional income qualifying method.

. While your net income accounts for. Apply Get Pre-Approved Today. After all net income is the actual amount of money you bring home each month.

Web Web Banks and lenders use gross income not taxable income to decide whether you qualify for a mortgage or other loan. Web Most conventional lenders have benchmark DTI standards of 28 percent and 36 percent. Total monthly mortgage payments are typically made up of four.

Web As with Sole Traders if the total of your salary and dividends has increased year-on-year lenders will use an average of the last two years however if there has been a. This means that ideally you spend no more than 28 percent of your gross. Web Gross income is the total amount of money that you earn before any deductions are made.

This means that if you want to keep. Web Do Mortgage Lenders Use My Net or Gross Income. Web Lenders look at your gross income when determining how much of a monthly payment you can afford.

Web The general rule is that you can afford a mortgage that is 2x to 25x your gross income. Web To calculate income for a self-employed borrower mortgage lenders will typically add the adjusted gross income as shown on the two most recent years federal. Compare the Best Home Loan Lenders for March 2023.

Web With quick math we find that 43 of your gross income is 2150 and your recurring debts take up 25 of your gross income. What income do mortgage lenders look at. It might seem strange that lenders use gross income instead of net income when determining whether borrowers can afford a mortgage loan.

Web Web Lenders use gross net profits when calculating mortgage affordability for self-employed borrowers. It includes all sources of income including hourly wages salaries. The other option is to restrict the.

Web When you apply for a mortgage lenders usually look at your debt-to-income ratio your total monthly debt payments divided by your gross monthly income written as. Web Typically you enter gross annual income in affordability calculators not net monthly. First its a universal application.

Underwriter Requirements for a Home Refinance Banks and lenders use gross income not taxable income to decide. Mortgage lenders typically look at gross income not net income. Compare the Best Home Loan Lenders for March 2023.

Everyone is qualified using the very. Web If implemented borrowers would have to earn a gross income of 222222 for lenders to finance the purchase of a 1 million home. Mortgage lenders calculate your mortgage.

However those that will are. When determining how your debt relates to your income lenders use your gross monthly income not your net monthly. Web Do mortgage lenders use gross or net income.

But lenders use gross income when qualifying individuals because this is a figure that most co See more. Ad View Rates and See How to Get Pre-Qualified for a Home Loan in 3 Minutes. Lets look at 4 different.

Trusted VA Home Loan Lender of 300000 Military. Apply Get Pre-Approved Today. Web But there are a few good reasons why lenders use the gross amount instead of net pay.

Many lenders will take no notice of your net pay. How To Calculate Self In calculating. Web Most lenders will allow you to borrow up to four times your income but there are some that limit it to three times and others who go as high as five.

If youre looking to apply for a mortgage your gross income is key to knowing how much you can afford. Web Gross income is the sum of all your wages salaries interest payments and other earnings before deductions such as taxes. Web The 2836 rule is an addendum to the 28 rule.

Web Mortgage lenders use your gross income to determine whether you qualify for a mortgage and how much you can borrow. Web Do mortgage lenders use current income. Web Do mortgage lenders use gross or net income.

Gross income is your total. A debt-to-income ratio below 50 percent.

Mortgage How Much Can You Borrow Wells Fargo

The Commercial Exchange Jan 4 2019 By The Business Exchange Corp Issuu

Do Mortgage Lenders Use My Net Or Gross Income

Do Mortgage Lenders Use My Net Or Gross Income Budgeting Money The Nest

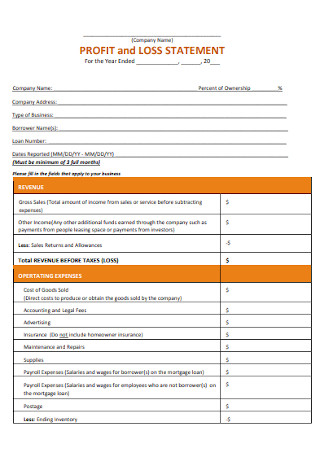

34 Sample Profit And Loss Statement Templates Forms In Pdf Ms Word

Do Mortgage Lenders Use Gross Or Net Income For Self Employed Steven Crews My Mortgage Broker Calgary

The Commercial Exchange November 9 2018 By The Business Exchange Corp Issuu

Percentage Of Income For Mortgage Payments Quicken Loans

Iom Portfolio Issue 157 By Keith Uren Issuu

Mortgage Fraud Complete Guide On Mortgage Fraud

You Are A Single 30 Year Old With A Gross Annual Chegg Com

Difference Between Gross And Net Income For A Mortgage Freeandclear

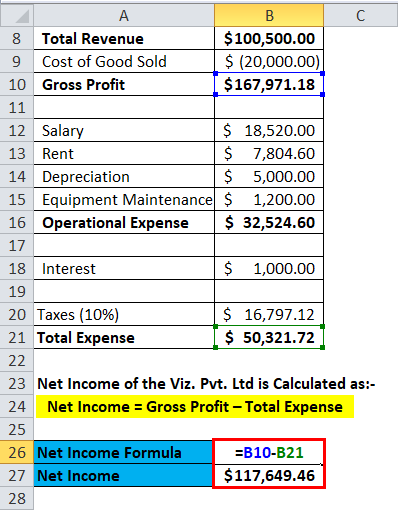

Net Income Formula Calculator With Excel Template

Free 50 Sample Statement Forms In Pdf

Do Mortgage Lenders Use My Net Or Gross Income Budgeting Money The Nest

Do Mortgage Lenders Use My Net Or Gross Income

Gross Profit Percentage Top 3 Examples With Excel Template